FF-7 Financial Freedom Formula

Achieve Long-Term Financial Stability with Our Proven Seven-Step System

Take control of your financial future with our comprehensive approach to lasting financial health and security.

INVESTING

RISK MANAGEMENT

SAVING

BUDGETING

YOUR GUIDE TO LASTING FINANCIAL

HELP & SECURITY

Achieving financial fitness is about more than just managing money—it’s about creating lasting habits that lead to long-term financial freedom. The system offers a holistic approach, helping you take control of your finances and develop the confidence to secure your financial future.

OVERVIEW

The 7 Layers of Financial Freedom

Pay Yourself First

Learn how to prioritize savings and investments by paying yourself first before anything else.

Emergency Fund

Establish a robust emergency fund (3-6 months of living expenses) to safeguard against financial challenges.

Survival Preparation

Prepare for the unexpected with survival planning that keeps you financially secure in times of crisis.

Long-Term Savings

Explore different strategies for building long-term savings, whether for retirement or other long-term goals.ure in times of crisis.

Certificates of Deposit (CDs), Bonds

Understand how to diversify your savings using CDs, bonds, and money market accounts for steady returns.

Stocks & Real Estate

Learn how to leverage stocks and real estate to build wealth and increase your financial portfolio.

Speculative Ventures & Start-Ups

Explore higher-risk, higher-reward opportunities like speculative ventures and start-ups to grow your wealth.

1. BUDGETING & SAVING

One key element of financial fitness is budgeting and saving. This involves creating a budget that accurately reflects your income and expenses and developing a savings plan that allows you to set aside money for short-term and long-term goals.

2. DEBT MANAGEMENT

Debt management is another important element of financial fitness. This involves managing your debts responsibly, including paying your bills on time, reducing your debt load, and avoiding high-interest debt.

3. INVESTING

Investing is another important component of financial fitness. By investing your money wisely, you can grow your wealth and build a secure financial future.

4. RETIREMENT PLAN

Retirement planning is also a critical aspect of financial fitness. This involves planning for your retirement years, including saving enough money to retire comfortably and making sure you have a solid retirement plan in place.

5. RISK MANAGEMENT

Finally, risk management is an important component of financial fitness. This involves protecting your assets and income from unexpected events, such as accidents, illnesses, or job loss, by having appropriate insurance coverage and emergency savings.

6. FINANCIAL LITERACY SKILLS

Developing financial literacy skills is also a key part of achieving financial fitness. This involves educating yourself about financial terminology, concepts, and principles, and knowing how to use financial tools and resources effectively.

🎓 Get Ready — The FF-7 Online Course Is Coming!

Take your financial journey even deeper with the upcoming

FF-7 Online Course, designed to walk you step-by-step through all 7 layers of the Financial Fitness System.

This self-paced course will include:

🎥 Video Lessons

📝 Interactive Worksheets

📊 Real-World Application Scenarios

🧭 Weekly Action Steps & Coaching Prompts

You’ll learn how to apply the 47 financial principles to your own life — from budgeting to building long-term wealth.

Frequently Asked Questions

1. What is the F7 Financial Freedom Formula?

The Financial Fitness Pathway Program is a comprehensive financial education and coaching service designed to empower individuals to take control of their finances, achieve financial goals, and secure a stable future.

2. What options are available within the F7 Financial Freedom Formula?

There are three options to choose from:

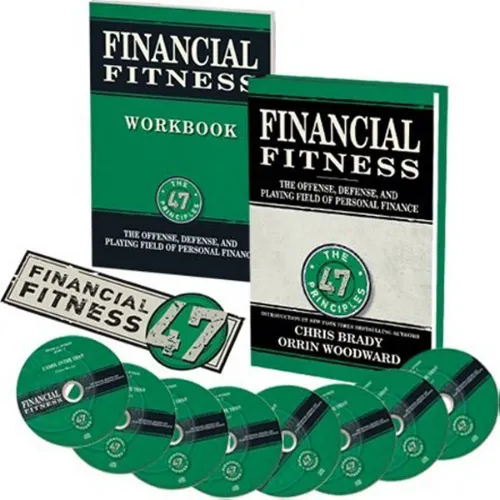

Financial Fitness Only (Digital or Physical): Includes the Financial Fitness system for personal use.

(COMING SOON) Financial Fitness Mastery Program: Offers the Financial Fitness system with a physical copy and group accountability coaching.

(COMING SOON) Financial Fitness Accelerator Program: Includes VIP Coaching for an accelerated and personalized financial transformation

3. Can I choose between digital and physical versions of Financial Fitness Only?

Yes, you have the option to choose between the Digital or Physical version of Financial Fitness Only based on your preference for accessing the system.

4. How will the F7 Financial Freedom Formula benefit my financial well-being?

The F7 Financial Freedom Formula equips you with essential financial knowledge, tools, and strategies to improve your financial health, reduce debt, increase savings, and secure a more stable financial future.

5. Can I purchase additional coaching or upgrade my program later?

Yes, you may have the option to add coaching services or upgrade your program at any time based on your financial goals and needs.

6. Is the F7 Financial Freedom Formula suitable for all income levels?

Absolutely! The program is designed to cater to individuals from all income levels, helping them build a strong financial foundation and achieve financial freedom.

7. How do I get started with the F7 Financial Freedom Formula?

To get started, visit our website or contact us directly. We'll guide you through the available options and recommend the best pathway to embark on your journey to financial fitness and success.

READY TO START YOUR FINANCIAL FITNESS JOURNEY BUT HAVE QUESTIONS?

Have a question or ready to get started?

Connect with us today for a free strategy session.

Humble, TX 77346

Houston, TX 77346

Office: 346-515-HELP(4357)

Fax: 346-662-2003